multistate tax commission members

US Supreme Court Agrees to Consider Sovereign Immunity Case Specifically Whether Nevada vHall Should be Overruled. The governor shall appoint the member of the multistate tax commission to represent New Mexico from among the persons made eligible by Article VI 1a of the compact 7-5-1 NMSA 1978.

Multistate Tax Commission Home

Utah State Tax Commission Issues Guidance on State Tax Treatment of IRC Sec.

. Drop Us a Line. In addition 70 of the members surveyed indicated that confidential information. Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate.

SERVING THE ENTIRE US. Let us know if you have any questions. 1953 Comp 72-15A-39 enacted by Laws 1967 ch.

MULTISTATE TAX COMPACT 57-59-01. MEMBERS OF BBB NATP. Member of NJCPA AICPA.

It consists of eight citizens appointed by the Governor. Multi State Tax Inc Home. MON FRI 800am 400pm.

Our members advise clients on federal state and international tax. Check New York Income Tax Refund. In addition the Governor is an ex-officio non-voting member.

Appointment of multistate tax commission member. The commission shall not act unless a. Rest easy knowing your taxes will be properly handled with the help from the experienced team at Multistate Tax Inc.

The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. The Nevada Tax Commission.

LOCATED IN NEWARK DE. S are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the Commission. Deloitte refers to one or more of the US member firms of.

SAT Please ask for an Appointment. FOLLOW US ON. 965 Deferred Foreign Income SalesUseIndirect.

17-1299 US petition for cert. C Each member shall be entitled to one vote. These states join in shaping and supporting the Commissions efforts to preserve state taxing authority and improve state tax policy and administration.

Each commissioner will serve an initial four-year term and can serve more than one. Multistate Tax Commission June 13 2018 Page 2 of 10 The AICPA is the worlds largest member association representing the accounting profession with more than 431000 members in 137 countries and territories and a history of serving the public interest since 1887. See forthcoming Multistate Tax Alert for more details on this case as well as related taxpayer considerations and please contact us with any questions.

86-272 income tax immunity. The multistate tax compact is hereby entered into law and entered into with all jurisdictions. Granted 62818The US Supreme Court Court has agreed to the California Franchise Tax Boards FTB request to review a case whose.

Established by Nevada Revised Statute 360010 the Nevada Tax Commission is the head of the Department of Taxation. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. Subdivisions affected by this compact to consult with the commission member from that state.

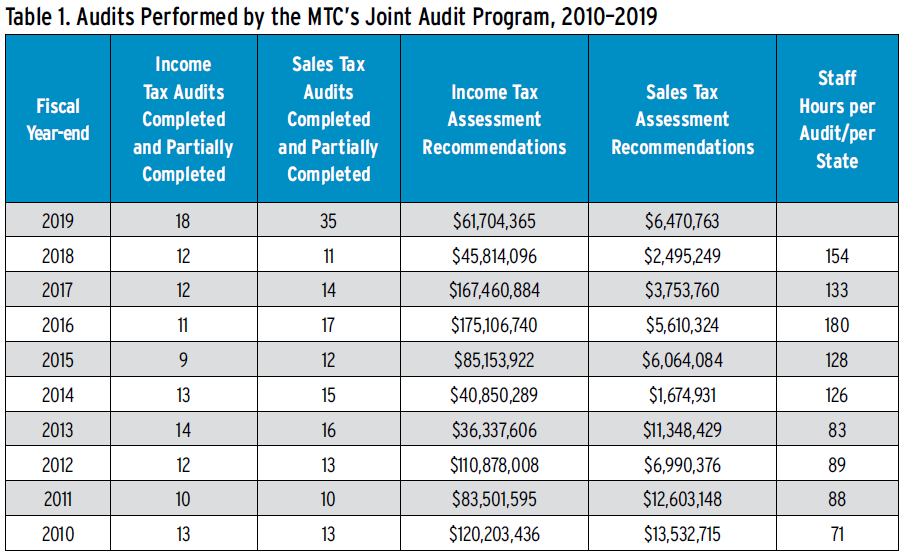

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Uniformity Committee Memo Multistate Tax Commission

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

.jpg.aspx)

Multistate Tax Commission News

Chris Barber Counsel Multistate Tax Commission Linkedin

Multistate Tax Commission News

Multistate Tax Commission Home

Multistate Tax Commission Partnership Work Group Update

Multistate Tax Commission News

Chris Barber Counsel Multistate Tax Commission Linkedin

Multistate Tax Commission With Helen Hecht Taxops

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Greg Matson Executive Director Multistate Tax Commission Linkedin

Ppt Importance Of State And Local Tax Planning Powerpoint Presentation Id 3058059

Implementing Recent Mtc Guidelines Pl 86 272 And The Finnigan Method Cpe Taxops